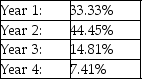

A tractor costing $80,000 is depreciated using MACRS. The tractor qualifies as a 3-year property, and has a scrap value of $20,000. The depreciation rates are:  What is the depreciation expense for year 2?

What is the depreciation expense for year 2?

Definitions:

Decentralization

The distribution of administrative powers or functions across various levels within an organization, as opposed to having them concentrated at a single point.

Advantage

Advantage refers to a favorable position or condition that enhances the probability of success or effectiveness in a competitive environment.

Responsibilities

Duties or obligations that an individual or organization is required or expected to perform.

Decentralization

The distribution of decision-making powers and operational activities away from a central authoritative location or group.

Q31: Patterson Research has 200 shares of 10%,

Q39: The cash purchase of treasury stock was

Q49: A depreciation method that allocates depreciation of

Q56: Determine the amount of the adjustment for

Q65: An entry to appropriate a portion of

Q79: A purchase of land and buildings would

Q91: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5850/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q93: In computing interest, it is required to

Q108: In the basic formula for calculating interest

Q118: When an account receivable is exchanged for