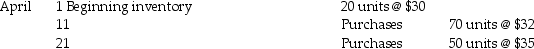

Calculate the ending inventory under each of the following methods given the information below about purchases and sales during the year. Assume a periodic inventory system.

Sales for April: 115 units

Sales for April: 115 units

a)________ FIFO

b)________ LIFO

c)________ Weighted-average

Definitions:

Sole Proprietor

A business owned and operated by a single individual, with no legal distinction between the owner and the business entity.

Deduct Business Losses

The process of reducing taxable income by the amount of losses incurred by a business during a financial period.

Charging-Order Creditor

A creditor's legal right to attach a debtor's interest in an LLC or partnership, as a means to satisfy the debtor's outstanding obligation.

Lien Creditor

A creditor who has a legal right or claim against a debtor's property as security for a debt or charge.

Q54: An amount determined by the corporation directors

Q56: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5850/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q68: All of the following are intangible assets

Q71: A change in ownership terminates the corporation.

Q79: In the perpetual inventory system, it is

Q80: Which method uses an aging of Accounts

Q95: A $10,000, 7% note is dated May

Q108: What would be the depreciation expense in

Q112: For the maker, being given additional time

Q115: Prepare journal entries for the following transactions