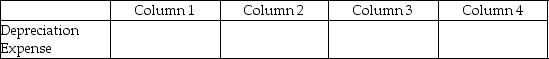

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the account's nature (permanent/temporary).

-

Definitions:

FICA Taxes Payable

Amounts owed by employers and employees for Social Security and Medicare, based on the Federal Insurance Contributions Act.

State Unemployment Taxes

Taxes imposed on the employer by states that provide benefits to employees who lose their jobs.

Employee's Withholding

The portion of an employee's wages withheld by the employer for payment of taxes and other deductions.

Federal Unemployment Tax

A United States federal tax imposed on employers to fund state workforce agencies. Employers pay this tax to the Internal Revenue Service (IRS) to cover the costs of unemployment compensation to workers who have lost their jobs.

Q5: On December 31, 2010, Paint Pros had

Q15: In the basic formula for calculating interest,

Q29: In which section does Interest Revenue appear

Q37: A major cost of selling goods on

Q43: The term used when the seller is

Q51: Special journals are used to:<br>A)minimize the amount

Q62: The discount period begins with the date

Q109: The beginning inventory of this year is

Q116: The seller's sales invoice is the buyer's

Q124: The discount period begins when the note