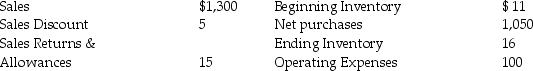

Calculate: (a)net sales, (b)cost of goods sold, (c)gross profit, and (d)net income from the following:

Definitions:

Amortization Expense

Amortization Expense is the gradual recognition of the cost of intangible assets over their useful life, reflecting how these assets contribute to revenue generation over time.

Accumulated Amortization

The total amount that has been amortized or written off for an intangible asset over its useful life up to a specific date.

Straight-line Method

A technique for distributing the expense of a physical asset uniformly throughout its lifespan.

Salvage Value

An asset's remaining worth estimated at the conclusion of its life of use.

Q9: Which financial statement is prepared first?<br>A)Statement of

Q22: Katelyn purchased $11,000 of new electronic equipment

Q29: An expense should be recorded when:<br>A)the bill

Q36: The adjusting entry to record rental income

Q44: The financial statement that shows business results

Q55: If 'Ol Fashioned Toys' revenues are less

Q56: The entry to record a payment on

Q63: Steps in the innovation cycle of the

Q76: Bill's Bikes discounts a 90-day, 8%, $4,000

Q130: The journal entry to record the payment