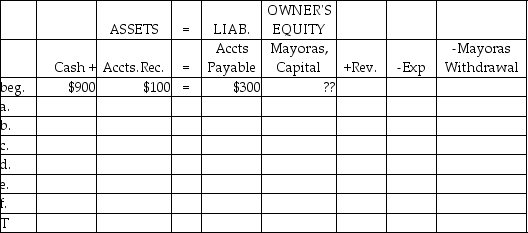

Record the following transactions into the expanded accounting equation for the Mayoras' Law Firm. Note that all titles have beginning balances. (You will need to determine the beginning capital balance.)

a. Provided legal services for cash, $1,200

b. Billed customers for services rendered, $2,400

c. Received and paid the monthly utility bill, $300

d. Collected $600 on account from customers

e. Paid supplies expense, $250

f. Withdrew $300 cash for personal use

Definitions:

MACRS

Modified Accelerated Cost Recovery System, a method of depreciation in the United States that allows businesses to recover investments in certain property through tax deductions over a specified life.

Scrap Value

The estimated value that an asset will realize upon its sale at the end of its useful life; often used in depreciation calculations.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting wear and tear, obsolescence, or other declines in value.

Depreciable Rate

The rate at which an asset loses its value over time for accounting and tax purposes, determining its annual depreciation.

Q27: Prepare the necessary general journal entry for

Q42: If a debit memorandum is issued, the

Q54: Which of the following NPV analysis methods

Q66: When the adjustment is made for depreciation,

Q68: Mortgage Payable is an expense account.

Q71: If total liabilities increased by $6,000 and

Q96: Which of the following transactions would cause

Q115: When expenses are greater than revenue, net

Q124: The Freight-in account is a Cost of

Q125: The income statement is a financial statement