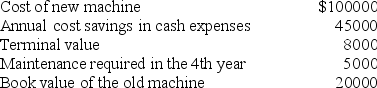

Arnold is acquiring a new machine with a life of 5 years for use on its production line. The following data relate to this purchase:  The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The present value of the total savings (excluding the maintenance in year 4) in annual cash operating costs is

Definitions:

Discount

A reduction to the usual price of goods or services, or in finance, the difference between the face value of a bond and its selling price.

Forego Discount

Choosing not to take advantage of early payment discounts offered by suppliers or creditors.

Costly Trade Credit

Refers to the high cost associated with the short-term financing obtained by buyers from suppliers when they choose to delay payment.

Gross Purchases

The total amount of all purchases made by a business before deducting any discounts, returns, or allowances.

Q16: Vic's Mart collects $700 of its accounts

Q17: Under a traditional accounting system any build

Q22: Which of the following is not a

Q41: Planning this year's expenditure based solely on

Q42: Bern & Sons invested in a project

Q51: For overhead variances, the difference between the

Q59: In non-routine situations, managers must identify the

Q64: Ray Company's projected sales budget for the

Q74: Hyteck Ltd is a capital intensive firm.

Q87: DBR is considering the purchase and implementation