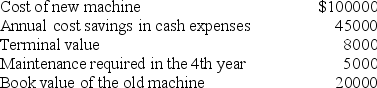

Arnold is acquiring a new machine with a life of 5 years for use on its production line. The following data relate to this purchase:  The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The present value of the terminal cash flows is

Definitions:

Technology Companies

Firms that produce or provide technology products and services, including software development, electronics manufacturing, and information technology services.

Reported Performance

The presentation of a company's operational and financial achievements over a specific period, typically as stated in its financial statements.

P/E Ratio

The price-to-earnings ratio, a measure of a company's current share price relative to its per-share earnings.

Accounting Methods

Systems and rules used for measuring, tracking, and recording a company’s financial transactions, often influencing how income and expenses are reported.

Q8: The physical output method of joint product

Q18: The main thrust of Australian government regulations

Q24: Once balanced scorecard measures have been chosen,

Q43: These steps in ethical decision making occur

Q60: Use the following information to prepare 1)an

Q67: The cash budget is included in an

Q71: Wasson Widget has 1,000 obsolete widgets on

Q72: The nominal method of NPV analysis adjusts

Q74: When evaluating actual results at the end

Q102: Redmond Ltd is closing one of its