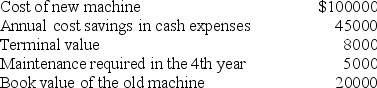

Arnold is acquiring a new machine with a life of 5 years for use on its production line. The following data relate to this purchase:  The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The present value of the cash flows for year 4 is

Definitions:

Process Operations

A method of production that involves continuous processing of materials to produce goods or provide services.

Work In Process Inventory

The account on the balance sheet representing the cost of the incomplete goods that are still in the process of production.

Equivalent Units

A concept in cost accounting used to allocate costs to partially completed goods, converting them into the amount of finished goods units they represent.

Equivalent Units

A concept in cost accounting used to apportion costs to partially completed goods, expressed in terms of fully completed units.

Q9: Managers should always emphasise products with the

Q14: Under the general quantitative rule, a project

Q15: An organisation can reduce its carbon footprint

Q18: TFS Ltd, a retail company selling hotel

Q29: To make a decision about a special

Q29: Under a total quality management approach entities

Q42: The use of a bonus bank in

Q75: Vicade has 1,000 commercial video game machines

Q75: George Shaw & Co invested in a

Q89: Uniform cash flows from a capital project