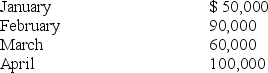

Gold Company has the following balances at 31st December 2010: Cash $6,000; accounts receivable $34,000 ($10,000 from November and $24,000 from December) ; merchandise inventory $40,000; and accounts payable $20,000 (for merchandise purchases only) . Budgeted sales follow:  Other data:

Other data:

· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

The cash disbursements for purchases in March are

Definitions:

Technology-based Training

Instructional programs or courses delivered using digital tools and platforms.

Generative Learning

Learning that emphasizes understanding and applying knowledge in new and different situations through the integration of new information with existing knowledge.

Synchronous Training

Training that occurs in real-time, where participants and instructors interact simultaneously, often through digital platforms.

Asynchronous Training

A learning format that allows participants to complete training activities at their own pace without needing to be concurrently online with instructors or peers.

Q13: TNR is preparing its budgeted income statement

Q27: The Gold Coast Division of Vallance Ltd

Q35: In an outsourcing decision, the general rule

Q41: The cost of implementing an ABC system

Q46: The availability of activity costs is inversely

Q49: Burkett Company uses a standard cost system.

Q68: Brady Ltd uses a normal absorption costing

Q94: Activity-based management relies on<br>A) Accurate ABC information<br>B)

Q101: How do managers decide which variances are

Q121: If a service organisation is at capacity,