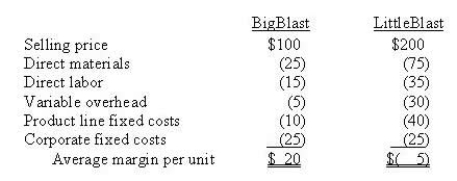

Horton and Associates produces two products named BigBlast and LittleBlast. Last month 4,000 units of BigBlast and 1,000 units of the LittleBlast were produced and sold. Following are average prices and costs for last month:  The production lines for both products are highly automated, so large changes in production cause very little change in total direct labor costs. Workers who are classified as direct labor monitor the production line and are permanent employees who regularly work 40 hours per week. All costs other than "corporate fixed costs" listed under each product line could be avoided if the product line were dropped. Using only the information provided above, Horton could make several types of decisions. Possible decisions include

The production lines for both products are highly automated, so large changes in production cause very little change in total direct labor costs. Workers who are classified as direct labor monitor the production line and are permanent employees who regularly work 40 hours per week. All costs other than "corporate fixed costs" listed under each product line could be avoided if the product line were dropped. Using only the information provided above, Horton could make several types of decisions. Possible decisions include

Definitions:

Interfering

The act of impeding or meddling in the affairs or processes of others, potentially causing disruption or hindrance.

Choice Decisions

The cognitive process of selecting among multiple options or actions in various contexts.

Government Intervention

The active involvement of a government in the economic, social, or political matters of a country, typically to correct market failures or promote social welfare.

Black Market

An illegal trade of goods or services where transactions occur beyond governmental control or are not sanctioned by law.

Q1: The relative performance evaluation approach advocated by

Q2: Which of these statements concerning the determination

Q20: Under the variable costing method, fixed production

Q25: When an organisation implements activity-based budgeting, managers

Q28: Generally all the costs assigned to a

Q36: Equivalent whole units of production<br>A) Are the

Q51: Opportunity costs are often relevant in make

Q54: Kelly Ltd uses a weighted-average process costing

Q61: Which statement about costing systems is true?<br>A)

Q116: The process for addressing a non-routine operating