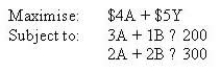

Tyke, Ltd. produces 2 products A and B, each requiring direct material and labor. Total labor available is 200 hours, and 300 pounds of material. Each unit of A sells for $10, and B sells for $15. Given the following linear programming information:  What are the variable costs per unit for A and B?

What are the variable costs per unit for A and B?

Definitions:

Real Estate Taxes

Taxes levied on land and buildings (real property) by governments, based on the property's value.

Networking

The practice of interacting with others to exchange information and develop professional or social contacts.

Incubators

Organizations designed to support the development of startup companies by providing resources, mentorship, and often capital.

Triple-Net Lease

A lease in which the tenant pays a base monthly rent plus real estate taxes, insurance, and any other operating expenses incurred for the building.

Q29: Under the direct method of allocating support

Q55: PFA Ltd uses a throughput costing system

Q57: In a production budget, beginning inventory plus

Q60: All organisations that use activity-based costing also

Q66: Cash flows to be considered in capital

Q72: At the end of 2009, SWP prepared

Q75: The method for determining the cost function

Q82: Because of grants, donations, and interest from

Q90: Cost accounting systems were originally developed to<br>A)

Q92: CVP analysis can be used to make