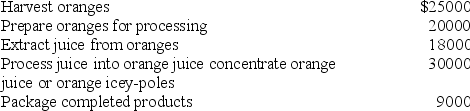

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Which of the following activities is likely to be classified as product-level?

Definitions:

Creolization

The process through which creole languages and cultures emerge from the blending of different societies and traditions.

Global Consumption Ethic

The set of moral principles and values that guide consumption behaviors on a global scale, often promoting sustainability and ethical consumerism.

Homogenized

A process where elements are made uniform or similar in structure or composition.

Refractory Period

The period immediately following a stimulus during which a nerve or muscle is unresponsive to further stimulation.

Q1: The relative performance evaluation approach advocated by

Q6: Managers can use cost-volume-profit analysis to I

Q10: The Kaizen approach to budgeting was developed

Q30: Managers should discontinue a business if which

Q31: The general rule is to discontinue a

Q39: Amsat has equipment that is in high

Q58: Intentionally understating revenues and / or overstating

Q69: Which of the following is not part

Q74: A costing system that determines an average

Q91: Accountants typically do not perform CVP analysis;