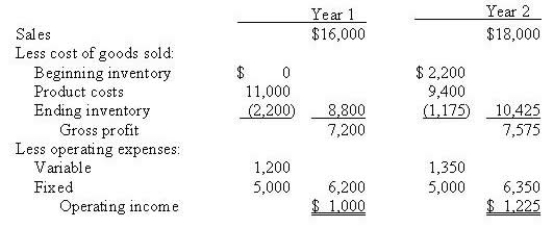

Bella Ltd has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were:  Cost of goods sold for year 1 using variable costing would be

Cost of goods sold for year 1 using variable costing would be

Definitions:

Quarterly Dividends

Dividends paid to shareholders by a corporation four times a year, usually at the end of each financial quarter.

Current Dividend Amount

is the total sum of money paid to shareholders in the most recent dividend distribution, based on the number of shares they own.

Trading Range

The difference between the highest and the lowest prices at which a security trades over a certain period of time.

Repurchase Range

The price range within which a company intends to buy back its own shares from the market, often to reduce the overall share count and increase shareholder value.

Q1: The relative performance evaluation approach advocated by

Q7: Support department cost allocation is necessary for

Q22: Changes in cost behavior over time are

Q31: TFS Ltd, a retail company selling hotel

Q34: Beginning work in process consists of 7,000

Q62: Which of the following is the most

Q65: In a process costing system, transferred-in costs<br>A)

Q73: The salary of the manager of a

Q85: A linear revenue function is one of

Q102: A favorable variance in one area might