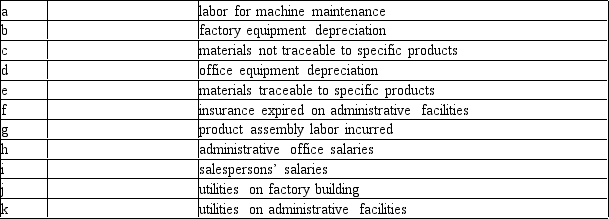

Classify the following costs as direct, indirect, or neither:

Definitions:

Schedule of Cost

A detailed report listing all costs associated with a project, including direct, indirect, fixed, and variable costs.

Manufactured

Refers to items that have been produced or constructed from raw materials in a factory setting.

Operations

The day-to-day activities required for continued business functioning, focusing on creating and delivering products or services.

Predetermined Overhead Rate

A rate used to apply manufacturing overhead cost to products, calculated before the manufacturing process begins based on estimated costs.

Q16: If the products of a manufacturing process

Q25: ZTL Ltd produces three products. Cost, price,

Q35: Indirect costs are traced and direct costs

Q37: If the organisation has only operated for

Q49: The fixed cost per unit varies with

Q56: Assuming that a cost is mixed and

Q71: A firm with fixed costs of $61,500

Q100: The first step in determining the cost

Q177: In most business organizations, the chief accountant

Q179: In a process costing system, costs flow