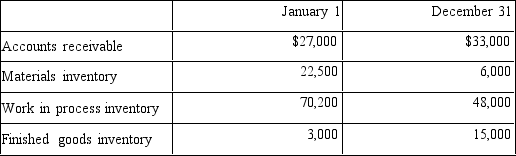

Davis Manufacturing Company had the following data:

Collections on account were $625,000.

Collections on account were $625,000.

Cost of goods sold was 68% of sales.

Direct materials purchased amounted to $90,000.Factory overhead was 300% of the cost of direct labor.

Compute:

a Sales revenue all sales were on account

b Cost of goods sold

c Cost of goods manufactured

d Direct labor used

e Direct materials incurred

f Factory overhead incurred

Definitions:

Cooperating

The act of working together towards a common goal or benefit, often seen in strategic partnerships between businesses or countries.

Prisoners' Dilemma

A situation in game theory where two individuals acting in their own self-interest do not produce the optimal outcome for either party.

Tit-For-Tat

A strategy in game theory where an entity responds to an action with a similar action, often seen in reciprocal altruism or in competitive contexts.

Repeated Game

A strategic situation where the same game is played numerous times, allowing participants to adjust their strategies based on past outcomes.

Q2: Data extracted from the accounting information system

Q15: Pete's Plastic Products makes plastic toys. The

Q26: Identify the following costs as a a

Q46: Organisational core competencies can include<br>A) A mission

Q50: The cost of production of completed and

Q61: Recording jobs shipped and customers billed would

Q66: Department A had 1,000 units in Work

Q71: A firm with fixed costs of $61,500

Q88: The trend line from a scatter plot

Q159: Another term for factory overhead is<br>A)surplus<br>B)period cost<br>C)supervisory