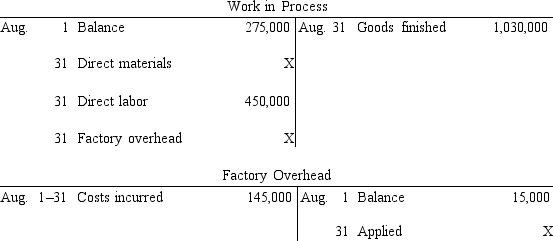

Selected accounts with some amounts omitted are as follows  If the balance of Work in Process at August 31 is $220,000, what was the amount debited to Work in Process for factory overhead in August, assuming a factory overhead rate of 30% of direct labor costs?

If the balance of Work in Process at August 31 is $220,000, what was the amount debited to Work in Process for factory overhead in August, assuming a factory overhead rate of 30% of direct labor costs?

Definitions:

Net Profit

The financial gain achieved after subtracting all expenses, taxes, and costs from total revenue.

Net Income

The total earnings of a company after subtracting all expenses, taxes, and costs, indicating the company's profitability.

Depreciation

The accounting process of allocating the cost of tangible assets over their useful lives, reflecting wear and tear or obsolescence.

Inventory

A company's merchandise, raw materials, and finished and unfinished products which have not yet been sold.

Q8: Estimating a cost function using past cost

Q13: Present entries to record the following summarized

Q19: Financial statements are<br>A) External reports produced from

Q23: Managers go through a series of questions

Q36: Using the FIFO method, the number of

Q56: Assuming that a cost is mixed and

Q57: Which of the follow is not an

Q58: If factory overhead applied exceeds the actual

Q68: In most business organizations, the chief management

Q187: Which of the following costs incurred by