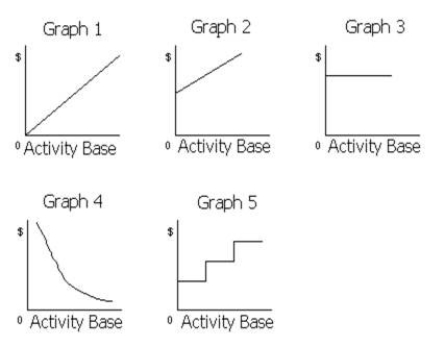

The cost graphs in the illustration below shows various types of cost behaviors.  For each of the following costs, identify the cost graph that best describes its cost behavior as the number of units produced and sold increases:

For each of the following costs, identify the cost graph that best describes its cost behavior as the number of units produced and sold increases:

a Sales commissions of $6,000 plus $0.05 for each item sold.

b Rent on warehouse of $12,000 per month.

c Insurance costs of $2,500 per month.

d Per-unit cost of direct labor.

e Total salaries of quality control supervisors.One supervisor must be added for each additional work shift.

f Total employer pension costs of $0.35 per direct labor hour.

g Per-unit straight-line depreciation costs.

h Per-unit cost of direct materials.

i Total direct materials cost.

j Electricity costs of $5,000 per month plus $0.0004 per kilowatt-hour.

k Per-unit cost of plant superintendent's salary.

l Salary of the night-time security guard of $3,800 per month.

m Repairs and maintenance costs of $3,000 for each 2,000 hours of factory machine usage.

n Total direct labor cost.

o Straight-line depreciation on factory equipment.

Definitions:

Light-Colored Fish

Refers to fish species that exhibit lighter shades of coloration on their bodies, possibly for reasons related to their habitat or evolutionary adaptations.

Proximate Causes

Immediate, underlying factors that explain how biological traits and behaviors occur, focusing on the "how" rather than the "why."

Ultimate Causes

Ultimate causes refer to the evolutionary reasons behind certain behaviors or traits, explaining why they have developed over time.

Mechanisms

The underlying processes or structures through which something operates or is achieved.

Q7: In variable costing, fixed costs do not

Q10: Flanders Industries collects 35% of its sales

Q13: Which of the following activity bases would

Q37: For the past year, Iris Company had

Q73: On the variable costing income statement, deduction

Q135: The ratio that indicates the percentage of

Q136: If the standard to produce a given

Q155: Define and discuss the two main types

Q195: In a cost-volume-profit chart, the<br>A)total cost line

Q206: If sales are $820,000, variable costs are