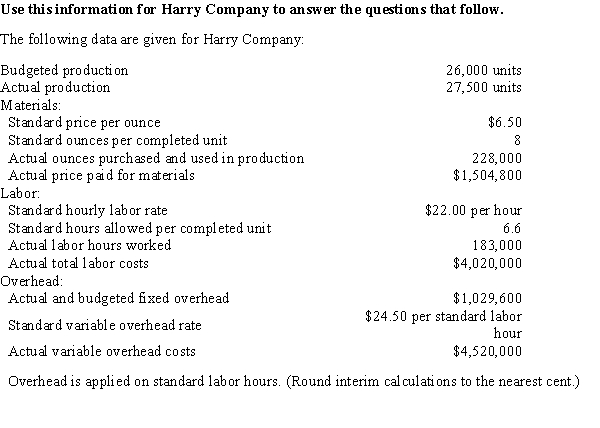

-Calculate the direct materials price variance.

Definitions:

Deferred Income Tax Liability

A tax obligation recorded on the balance sheet for income that has been recognized but not yet taxed.

Book Income Before Income Tax

This is the income an entity has earned before any taxes have been deducted, as reported in the financial statements.

Tax Depreciation

The depreciation expense allowed by tax authorities for tax calculation purposes, reflecting the reduction in value of assets over time.

Book Depreciation

The amount of depreciation expense that has been allocated for a fixed asset in a company's financial records.

Q1: Which is the best example of a

Q14: Jaxson Corporation has the following data related

Q16: Assume that Division Blue has achieved a

Q39: Heedy Company is trying to decide how

Q56: Standard cost variances are usually not reported

Q90: In the variable costing income statement, deduction

Q138: In most businesses, cost standards are established

Q147: Separation of businesses into more manageable operating

Q151: Methods that ignore present value in capital

Q152: The primary accounting tool for controlling and