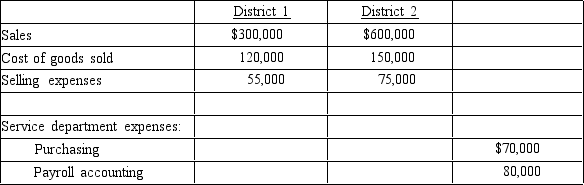

Using the data from the Terrace Industries, determine the divisional income from operations for Districts 1 & 2.

Allocate service department expenses proportional to the sales of each district.

Allocate service department expenses proportional to the sales of each district.

Definitions:

Variable Costing

A costing method that includes only variable manufacturing costs—direct materials, direct labor, and variable manufacturing overhead—in the cost of a unit of product.

Operating Expenses

Costs associated with the day-to-day operations of a business, excluding production costs but including items like rent, utilities, and payroll.

Net Income

The total profit of a company after all expenses, including taxes, cost of goods sold, and operating expenses, have been deducted from total revenue.

Variable Costing

Another perspective: A costing methodology that treats only those costs that vary with production level as product costs, emphasizing the impact of fixed costs on profitability.

Q16: Assume that Division Blue has achieved a

Q39: If the activities causing overhead costs are

Q40: The plant managers in a cost center

Q91: Since the controllable variance measures the efficiency

Q98: Product costing consists of only direct materials

Q106: Determine the markup percentage on variable cost.<br>A)100%<br>B)110%<br>C)80%<br>D)46.5%

Q139: Crane Company Division B recorded sales of

Q159: A company is planning to purchase a

Q170: Using the variable cost concept, determine the

Q170: An analysis of a proposal by the