Bentz Co.has two divisions, A and B.Invested assets and condensed income statement data for each division for the year ended December 31, are as follows:

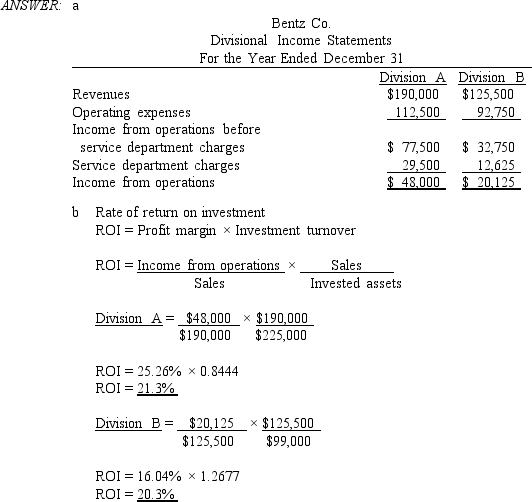

a Prepare condensed income statements for the past year for each division.

a Prepare condensed income statements for the past year for each division.

b Using the DuPont formula, determine the profit margin, investment turnover, and rate of return on investment for each division.Round the profit margin percentage to two decimal places and investment turnover to four decimal places.

Definitions:

Manufacturing Overhead

All the indirect costs associated with manufacturing a product, such as utilities, maintenance, and factory equipment depreciation, not directly traceable to a specific product.

Activity Cost Drivers

Refers to factors that influence or contribute to the expenses associated with different business activities.

ABC Costing System

Activity-Based Costing is an accounting method that assigns costs to products or services based on the activities that go into producing them.

Plantwide Overhead Allocation

A method of distributing overhead costs to all products or services based on a single cost driver across the entire plant or factory.

Q1: Proposals M and N each cost $550,000,

Q6: Determine the activity rate for materials handling

Q20: Using the tables above, what would be

Q31: Favorable volume variances may be harmful when<br>A)machine

Q49: The condensed income statement for a Hayden

Q60: The total factory overhead for Big Light

Q112: Finch, Inc.has bought a new server and

Q168: Miller's Quarter Horse Company has sales of

Q178: The average rate of return for this

Q185: If the profit margin for a division