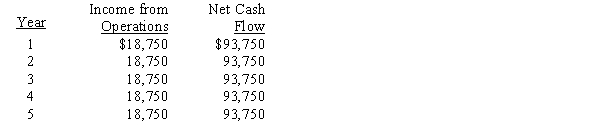

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The average rate of return for this investment is

Definitions:

Fight-Or-Flight Response

A physiological reaction that occurs in response to a perceived harmful event, attack, or threat to survival.

General Adaption Syndrome

A theoretical framework describing the body's short-term and long-term reactions to stress, including stages of alarm, resistance, and exhaustion.

Stressor

Any event, experience, or environmental stimulus that causes stress in an individual.

Emotional Catharsis

The process of releasing and thereby providing relief from strong or repressed emotions through particular activities or experiences, such as art, music, or therapy.

Q30: Assuming that Widgeon Co.can sell all of

Q46: Using a single plantwide rate, determine the

Q61: The process by which management allocates available

Q63: Push manufacturing is also referred to as

Q89: Which of the following is required by

Q134: The lean philosophy attempts to reduce setup

Q135: In a lean system, there are more

Q137: A qualitative characteristic that may impact upon

Q172: The expected average rate of return for

Q175: What is the contribution margin per machine