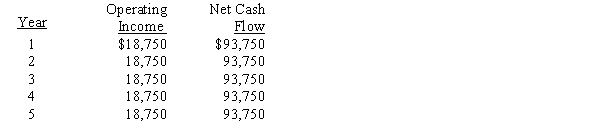

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The expected average rate of return for a proposed investment of $650,000 in a fixed asset, with a useful life of 4 years, straight-line depreciation, no residual value, and an expected total net income of $240,000 for the 4 years, is

Definitions:

Monopoly

A market structure characterized by a single seller, selling a unique product in the market with no close substitutes, often leading to less competition.

External Organizational Environment

Constitutes the outside forces, including economic, political, technological, and social factors, that affect an organization's operations.

Industry Environment

The external factors including economic, political, regulatory, and social that affect the operational, financial, and competitive landscape of industry sectors.

BCG Matrix

A strategic business tool designed by the Boston Consulting Group that evaluates the relative performance of an organization's product portfolio based on market growth rate and market share.

Q12: If net income is $150,000 and interest

Q14: Determining the transfer price as the price

Q21: If a company has issued only one

Q28: When using the variable cost concept of

Q68: In the lean principles philosophy, unexpected downtime

Q86: A loss on disposal of a segment

Q115: Allocated equally among divisions<br>A)Purchasing<br>B)Payroll accounting<br>C)Human resources<br>D)Maintenance<br>E)Information systems<br>F)Marketing<br>G)President's

Q117: The costs of initially producing an intermediate

Q127: The cash payback method of capital investment

Q164: The numerator of the rate earned on