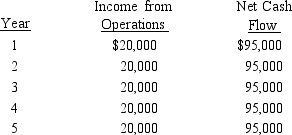

The management of Charlton Corporation is considering the purchase of a new machine costing $380,000.The company's desired rate of return is 6%.The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212.In addition to the foregoing information, use the following data in determining the acceptability of this investment:  The cash payback period for this investment is

The cash payback period for this investment is

Definitions:

Q8: The following items are reported on a

Q10: What is the contribution per machine hour

Q21: Determine the markup percentage on total cost.<br>A)100%<br>B)110%<br>C)80%<br>D)46.5%

Q60: actual cost < standard cost at actual

Q65: Which of the following items appear on

Q69: A plantwide factory overhead rate assumes that

Q94: By spending more in costs of controlling

Q102: An investment of $185,575 is expected to

Q123: The relationship of $325,000 to $125,000, expressed

Q143: The cash payback period for this investment