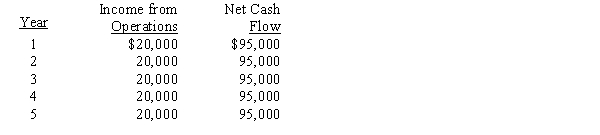

The management of River Corporation is considering the purchase of a new machine costing $380,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The net present value for this investment is

Definitions:

Operating Leverage

A measure of the proportion of fixed costs in a company's cost structure, indicating how a change in sales volume will affect operating income.

Cedar Shingles

Thin, tapered pieces of cedar wood used as durable roofing materials.

Net Operating Income

Income from a company's everyday business operations, excluding expenses from interest and taxes.

Monthly Sales

The total revenue generated from the sale of goods or services within a single month.

Q5: For Years 1-5, a proposed expenditure of

Q7: The number of times interest expense is

Q14: The following information was taken from Slater

Q22: The Camper's Edge Factory produces two products-canopies

Q53: Can be determined by initial cost divided

Q57: Manufacturers must conform to the Robinson-Patman Act,

Q73: Under the total cost concept, manufacturing cost

Q107: The minimum acceptable divisional income from operations

Q123: A quality control activity analysis indicated the

Q197: The sales, income from operations, and invested