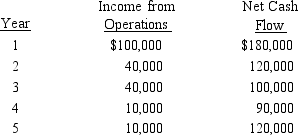

The management of Arkansas Corporation is considering the purchase of a new machine costing $490,000.The company's desired rate of return is 10%.The present value factors for $1 at compound interest of 10% for 1 through 5 years are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively.In addition to the foregoing information, use the following data in determining the acceptability of this investment:  The net present value for this investment is

The net present value for this investment is

Definitions:

Demand-for-loanable-funds

The desire for borrowing money from available financial resources, influenced by the interest rate.

Investment Tax Credit

A tax credit offered to firms or individuals that invest in certain types of assets, aimed at encouraging investment.

Loanable Funds Market

A theoretical market where borrowers and lenders interact, facilitating the lending and borrowing of funds based on interest rates.

Interest Rate

The expense allocated by a creditor to a debtor for the opportunity to use capital, quantified as a proportion of the principal.

Q1: Which is the best example of a

Q7: The amount of increase or decrease in

Q43: Condensed data taken from the ledger of

Q46: Preventive machine maintenance<br>A)Preventive costs<br>B)Appraisal costs<br>C)Internal failure costs<br>D)External

Q53: Common allocation bases are<br>A)direct labor dollars, direct

Q60: The profit margin for Central Division is

Q63: Push manufacturing is also referred to as

Q113: Yasmin Co.can further process Product B to

Q120: Controllable expenses are those that can be

Q141: Three measures of investment center performance are