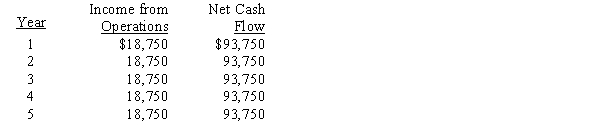

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The present value index for this investment is

Definitions:

R&D Expenditures

Funds allocated by a government, corporation, or other entity towards research and development activities aimed at innovating and improving products or processes.

Interest-Rate Cost-Of-Funds

The expense associated with borrowing funds, often determined by the interest rate at which money is borrowed.

Expected-Rate-Of-Return

The anticipated percentage of profit or loss an investment is likely to generate.

Immediate Costs

Expenses that are directly incurred and need to be paid out in the short term.

Q11: What is the amount of income or

Q12: A single plantwide overhead rate method is

Q59: Methods that ignore present value in capital

Q65: The management of Indiana Corporation is considering

Q65: Determine the overhead from both production departments

Q67: A company reports the following:<br>Cost of goods

Q154: The length of time it will take

Q158: Transfer prices may be used when decentralized

Q161: A series of equal cash flows at

Q203: The major shortcoming of income from operations