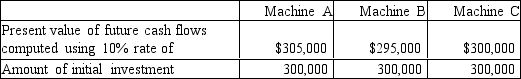

The production department is proposing the purchase of an automatic insertion machine.It has identified 3 machines and have asked the accountant to analyze them to determine which of the proposals if any meet or exceed the company's policy of a minimum desired rate of return of 10% using the net present value method.Each of the assets has an estimated useful life of 10 years.The accountant has identified the following data:  Which of the investments are acceptable?

Which of the investments are acceptable?

Definitions:

Federal Unemployment Taxes

Taxes imposed on employers to fund unemployment benefits, administered at the federal level.

Payroll Tax Expense

Taxes that an employer is responsible for paying on behalf of its employees, which can include federal and state income taxes, Social Security, and Medicare taxes.

FICA Taxes Payable

The amount due for Federal Insurance Contributions Act taxes, which fund Social Security and Medicare, required to be paid by employers and employees.

Interstate Commerce

Refers to any work involving or related to the movement of goods or services across state lines within the United States.

Q5: Differential revenue is the amount of increase

Q9: The budgeted cell conversion cost rate is

Q20: Which of the following does not rely

Q43: Which of the following expressions is termed

Q49: In a lean environment, the journal entry

Q92: A company is considering the purchase of

Q97: What is the rate of return on

Q108: Pinacle Corp.budgeted $700,000 of overhead cost for

Q132: The cost per unit for the production

Q137: A qualitative characteristic that may impact upon