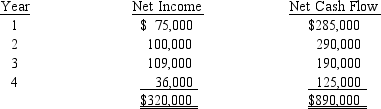

Dickerson Co.is evaluating a project requiring a capital expenditure of $810,000.The project has an estimated life of 4 years and no salvage value.The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%.The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.

The company's minimum desired rate of return is 12%.The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.

Determine the average rate of return on investment, including the effect of depreciation on the investment.

Definitions:

Male Nurse

A registered nurse who is male, working within various specialties of nursing. Nursing is a profession that is not limited by gender.

Nondenominational Chaplains

Spiritual caregivers who provide support and religious services to individuals of any or no specific faith in institutions like hospitals.

Spiritual Distress

A state of suffering related to the impaired ability to experience and integrate meaning and purpose in life through connectedness with self, others, art, music, literature, nature, or a power greater than oneself.

Noncompliance

The failure or refusal to act in accordance with prescribed instructions, rules, or regulations, often seen in medical or legal contexts.

Q17: A lean nonmanufacturing process can be accomplished

Q34: An 8-year project is estimated to cost

Q39: Hadley Company is considering the disposal of

Q50: The statement of cash flows shows the

Q60: The process by which management allocates available

Q60: In deciding whether to accept business at

Q139: The expected average rate of return for

Q167: Which product has the highest contribution margin

Q186: Brunette Company is contemplating investing in a

Q197: The sales, income from operations, and invested