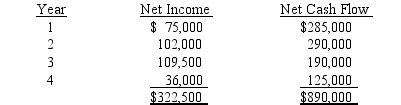

BAM Co.is evaluating a project requiring a capital expenditure of $806,250.The project has an estimated life of 4 years and no salvage value.The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%.The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.

The company's minimum desired rate of return is 12%.The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.

Determine: a the average rate of return on investment, including the effect of depreciation on the investment, and b the net present value.

Definitions:

Unconditioned Stimulus

A stimulus that naturally triggers a response without any need for learning.

Eyeblink Response

A reflex action of blinking the eyes, often as a protective response to stimuli or as a conditioned reaction.

Fear Conditioning

A behavioral paradigm in neuroscience used to study how organisms learn to predict aversive events, typically involving the association of a neutral stimulus with an aversive stimulus.

Q40: When a segment of a company is

Q41: Determine the average rate of return for

Q43: Which of the following expressions is termed

Q72: Preventive machine maintenance<br>A)Value-added<br>B)Non-value-added

Q81: Central Division for Chemical Company has a

Q106: Proposals A and B each cost $600,000

Q113: The following financial information was summarized from

Q118: Not relevant to future decisions<br>A)Opportunity cost<br>B)Sunk cost<br>C)Theory

Q134: The lean philosophy attempts to reduce setup

Q168: Miller's Quarter Horse Company has sales of