Norton Company is considering a project that will require an initial investment of $750,000 and will return $200,000 each year for 5- years.

a If taxes are ignored and the required rate of return is 9%, what is the project's net present value?

b Based on this analysis, should Norton Company proceed with the project?

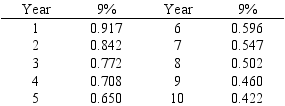

Below is a table for the present value of $1 at compound interest.

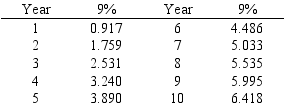

Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Economic Profits

Profits exceeding the next best alternative use of resources, considered abnormally high in economic terms.

ATC Curve

The Average Total Cost (ATC) curve is a graphical representation showing how the average total costs of production for a firm change as the quantity of output produced changes.

Demand Curve

A graphical representation showing the relationship between the price of a good or service and the quantity demanded by consumers.

Perfect Competitor

A theoretical market structure where many firms sell identical products, entry and exit are easy, and all firms are price takers.

Q19: What will the income of the Micro

Q20: A process-oriented layout segments production facilities into

Q58: The methods of evaluating capital investment proposals

Q59: If the order is accepted, what would

Q60: The process by which management allocates available

Q63: Push manufacturing is also referred to as

Q69: If in evaluating a proposal by use

Q135: The statement of cash flows is not

Q178: The average rate of return for this

Q196: Separate sales forces<br>A)Advantage of decentralization<br>B)Disadvantage of decentralization<br>C)Neither