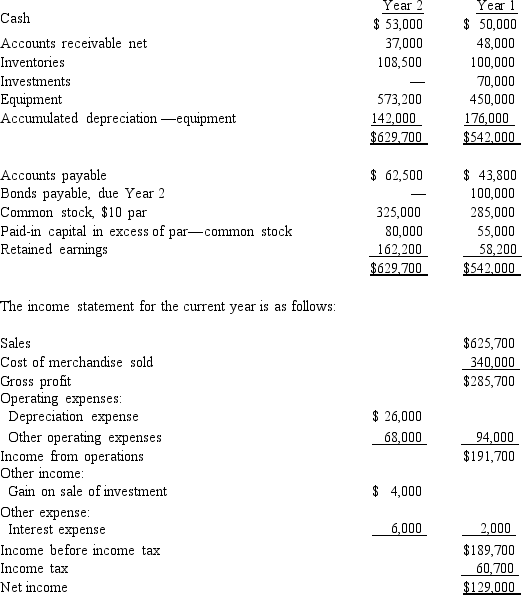

The comparative balance sheets of Posner Company, for Years 1 and 2 ended December 31, appear below in condensed form:

Additional data for the current year are as follows:

Additional data for the current year are as follows:

a Fully depreciated equipment costing $60,000 was scrapped, no salvage, and new equipment was purchased for $183,200.

b Bonds payable for $100,000 were retired by payment at their face amount.

c 5,000 shares of common stock were issued at $13 for cash.

d Cash dividends declared and paid, $25,000.

Prepare a statement of cash flow, using the indirect method of reporting cash flows from operating activities.

Definitions:

Bank Reconciliation

The method of aligning and scrutinizing numbers from financial records with those presented in a bank statement to verify their consistency.

Interest Earned

The income received from investments in financial instruments like savings accounts, bonds, and loans, usually calculated as a percentage of the principal amount.

Internal Control

A process implemented by a company’s management and board of directors to provide reasonable assurance regarding the achievement of objectives in effectiveness and efficiency of operations, reliable financial reporting, and compliance with laws and regulations.

Pre-numbered

Pre-numbered refers to documents or forms that are sequentially numbered in advance, aimed at preventing fraud and ensuring completeness in record-keeping.

Q2: The report on internal control required by

Q8: In Sunrise Group's consolidation worksheet, the opening

Q18: Where an investor sells inventory to an

Q28: Which of the following is an agricultural

Q29: Which of the following methods is inconsistent

Q58: The budgeted cell conversion cost rate includes

Q90: A company reports the following:<br>Income before income

Q96: On the basis of the following data

Q122: Conan Electronics Corporation manufactures and assembles electronic

Q144: In a vertical analysis, the base for