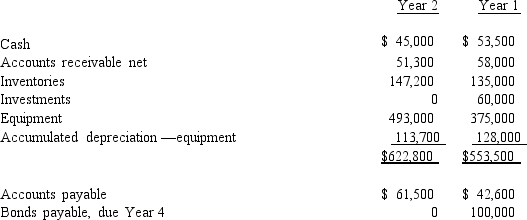

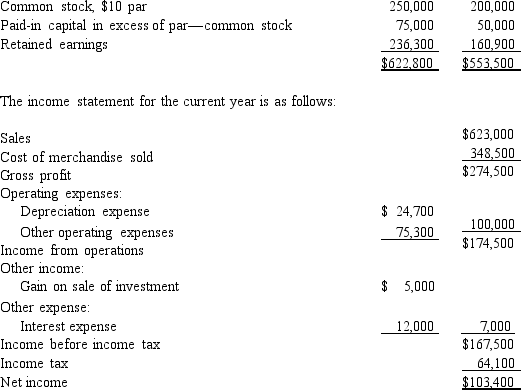

The comparative balance sheet of ConnieJo Company, for December 31, Years 1 and 2 ended December 31 appears below in condensed form:

Additional data for the current year are as follows:

Additional data for the current year are as follows:

a Fully depreciated equipment costing $39,000 was scrapped, no salvage, and equipment was purchased for $157,000.

b Bonds payable for $100,000 were retired by payment at their face amount.

c 5,000 shares of common stock were issued at $15 for cash.

d Cash dividends declared were paid $28,000.

e All sales are on account.

Prepare a statement of cash flows, using the direct method of reporting cash flows from operating activities.

Definitions:

Income Statement

An income statement is a financial document that summarizes an organization's revenue, expenses, and profit or loss over a specific period.

Manufacturing Costs

The total expenses involved in the production of goods, including direct materials, direct labor, and manufacturing overhead.

Costing Method

An accounting approach used to determine the cost of production or operation, such as FIFO, LIFO, or average cost method.

Absorption Costing

A method of accounting for costs in which all costs of manufacturing a product, including fixed and variable overheads, are absorbed by the products produced.

Q4: Alaskan Pattern Company makes dressmakers' patterns using

Q6: AASB 102 prohibits which of the following

Q9: The following item is classified as part

Q15: Which of the following is characteristic of

Q16: Under AASB 138 Intangibles, an intangible asset

Q21: A lessee when accounting for a lease

Q25: When applying a revaluation measurement model to

Q35: From the foregoing information, determine the amount

Q49: In a lean environment, the journal entry

Q176: State the sections of the statement of