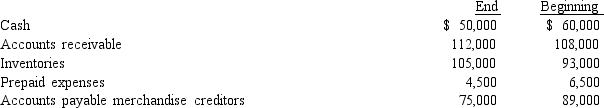

The net income reported on the income statement for the current year was $275,000.Depreciation recorded on fixed assets and amortization of patents for the year were $40,000 and $9,000, respectively.Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows:  What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

Definitions:

Specific Financing

Financing that is intended for a particular purpose or project, with clear specifications and usually backed by specific collateral.

After-Tax Cost

The expense of any financial obligation or investment after accounting for the effects of taxes.

Project Evaluation

The process of determining the potential successes or failures of a proposed project based on various criteria.

DCF Approach

A valuation method that estimates the value of an investment based on its expected future cash flows, adjusted for the time value of money.

Q4: A 60:40 joint operation was commenced

Q58: The budgeted cell conversion cost rate includes

Q79: Cash dividends paid on capital stock would

Q82: Financing activities include<br>A)lending money<br>B)acquiring investments<br>C)issuing debt<br>D)acquiring long-lived

Q96: The Anazi Leather Company manufactures leather handbags

Q101: Unusual items affecting the current period's income

Q110: Using vertical analysis of the income statement,

Q115: Current position analysis measures a company's ability

Q129: On the statement of cash flows, the

Q155: Which of the following should be deducted