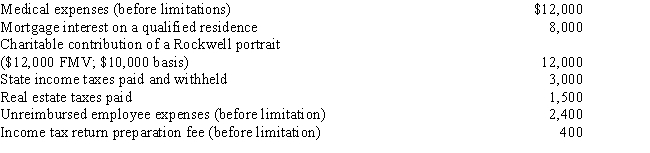

Eileen is a single individual with no dependents.Her adjusted gross income for 2017 is $60,000.She has the following items that qualify as itemized deductions.What is the amount of Eileen's AMT adjustment for itemized deductions for 2017?

Definitions:

Perfect Substitutes

Goods that a consumer is completely indifferent between, meaning they will substitute one for another at a constant rate regardless of any change in price or utility.

Perfect Complements

Goods that are always used together in fixed proportions, where the utility or value of one item increases with use of the other.

Pareto Efficient

An allocation condition in resources where any attempt to favor one individual results in a disadvantage to another.

Pareto Optimal

A state of allocation of resources from which it is impossible to reallocate without making at least one individual or preference criterion worse off.

Q1: The parents of a client recently diagnosed

Q14: A child is admitted with infective endocarditis.

Q19: Which of the following authorities can help

Q19: At the beginning of the current year,Harrison's

Q21: During 2017,Jimmy incorporates his data processing business.Jimmy

Q60: Sean Corporation's operating income totals $200,000 for

Q64: Does the selection of a corporate entity

Q72: Explain why a taxpayer would ever consider

Q92: Jane is a partner with Smithstone LLP.Smithstone

Q139: Capital gain and loss planning strategies include<br>I.the