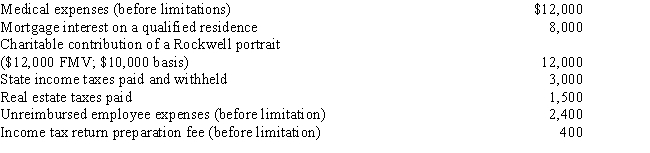

Eileen is a single individual with no dependents.Her adjusted gross income for 2017 is $60,000.She has the following items that qualify as itemized deductions.What is the amount of Eileen's AMT adjustment for itemized deductions for 2017?

Definitions:

Advertising Law

Regulations and legal standards that govern the ways in which products and services can be promoted to the public.

Deceptive Practices

Activities by individuals or businesses that mislead or lie to consumers, often regarding the nature or quality of a product or service.

Unfair Practices

Activities considered unethical or illegal, often related to business dealings, that can lead to consumer harm or market manipulation.

Discharged

Relieved from a legal duty, obligation, or liability, often in the context of debts or contractual obligations.

Q1: A pediatric client sustains a minor burn.

Q2: Primary sources of tax law include<br>I.Treasury Regulations.<br>II.IRS

Q3: The nurse is caring for an adolescent

Q4: A preschool-age child has just had a

Q12: The nurse is conducting a health history

Q13: Which athletic activity can the nurse recommend

Q29: Cisco and Carmen are both in their

Q31: In 2017,Henry purchases $210,000 of equipment with

Q55: The maximum contribution that can be made

Q88: Carson and Dan agree to become equal