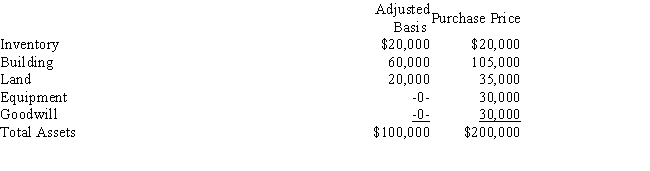

Dorothy operates a pet store as a sole proprietorship.During the year,she sells the business to Florian for $200,000.The assets sold and the allocation of the purchase price are as follows:

Dorothy acquired the building in 1997 for $100,000 of which $20,000 was allocated to the land.She paid $40,000 for the equipment in the same year.What are the tax consequences of the liquidation for Dorothy?

Definitions:

Limiting Condition

A condition or set of conditions that restricts the domain or range of a function or algorithm, often used to prevent errors or infinite loops.

Number of Elements

This term refers to the total count of items in a given set or collection.

Recursive Implementation

Recursive implementation involves solving a problem by having a function call itself as a subroutine, breaking down the problem into smaller, more manageable tasks.

Fibonacci Sequence

A series of numbers where each number is the sum of the two preceding ones, usually starting with 0 and 1.

Q17: The nurse is teaching the parents of

Q32: The general mechanism used to defer gains

Q78: Marybelle paid $400,000 for a warehouse.Using 39-year

Q87: What body has jurisdiction over all tax

Q94: Dwight,a single taxpayer,has taxable income of $75,000

Q95: Determine the proper classification(s)of a house owned

Q97: Which of the following is not a

Q99: Bison Financial Group has a health-care plan

Q107: Charles purchases an interest in a uranium

Q110: Wilshire Corporation purchased a commercial building in