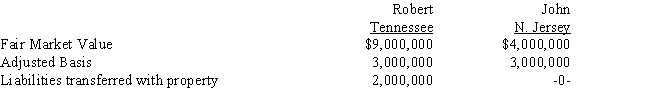

Robert trades an office building located in Tennessee to John for an apartment complex located in New Jersey.Details of the two properties:

In addition,John pays Robert $3,000,000 cash as part of this transaction.What is the gain (loss) recognized by Robert in this transaction and what is his basis in the New Jersey property?

Gain Recognized Adjusted Basis

Definitions:

Pelvic Bone Structure

The complex structure in the lower part of the torso, comprised of several bones including the sacrum and coccyx which support the spinal column and hips.

Holocene Epoch

The current geological epoch, starting approximately 11,700 years ago, following the last major ice age and characterized by the development of human civilizations.

Large Mammals

A categorization for mammals that are considerably larger than most other species, often including animals like elephants, whales, and bears.

Humans

A species of bipedal primates belonging to the genus Homo, particularly Homo sapiens, characterized by advanced cognitive abilities.

Q9: A school-age child is being assessed for

Q17: Why would a taxpayer ever elect to

Q19: The nurse is planning care for pediatric

Q24: The Holden Corporation maintains a SIMPLE-IRA retirement

Q28: Which of the following statements pertaining to

Q70: Which of the following qualify as replacement

Q89: Which of the following is/are correct regarding

Q98: Terry gives Brenda 1,000 shares of stock

Q133: Section 1250 recapture<br>A)Stocks,bonds,options.<br>B)Depreciable real property.<br>C)All or part

Q136: Tory sells General Electric stock (owned 10