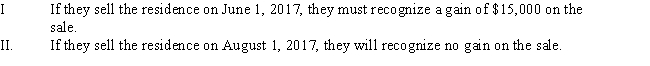

Charlotte purchases a residence for $105,000 on April 13,2004.On July 1,2015,she marries Howard and they use Charlotte's house as their principal residence.If they sell their home for $390,000,incurring $20,000 of selling expenses and purchase another residence costing $350,000.Which of the following statements is/are correct concerning the sale of their personal residence?

Definitions:

Purpose

The reason for which something is done or created, or for which something exists.

Voucher System

An accounting system that involves preparing and approving vouchers before transactions are recorded and payments made, to ensure financial controls.

Control Procedures

Measures and policies implemented by a company to ensure the integrity of financial and accounting information and compliance with laws and regulations.

Cash Equivalents

Temporary investments which can quickly be converted into specific cash sums and have a negligible risk of value fluctuation.

Q28: Robert trades an office building located in

Q49: The gain from the sale of qualified

Q50: Tillman is building a warehouse for use

Q56: Under current law,taxpayers must use regular MACRS.

Q59: Rosilyn trades her old business-use car with

Q78: Carlyle purchases a new personal residence for

Q80: Janet is the business manager for Greenville

Q100: Will and Brenda of New York City

Q105: Farm land for an office building and

Q152: Baylen,whose adjusted gross income is $60,000,purchases a