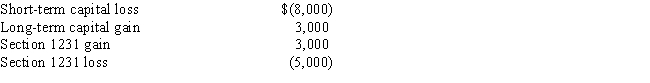

Gabrielle has the following gains and losses for the current year:

What is Gabrielle's net capital gain or loss position for the year?

Definitions:

Q3: Bronco Corporation realizes $270,000 from sales during

Q10: Shannon and Art are each 10% partners

Q24: Aaron purchases a taxicab (5-year MACRS property)for

Q30: Which regulation citation concerns Code Section 469?<br>A)Reg.Sec.469<br>B)Reg.Sec.469-3<br>C)Reg.Sec.1.3-469<br>D)Reg.Sec.1.469-3<br>E)Reg.Sec.469.72-3

Q47: When her property was fully depreciated and

Q76: Which of the following taxes is deductible

Q86: Amount realized<br>A)Begins on the day after acquisition

Q88: George's wife sells stock she purchased 10

Q104: Commonalties of nonrecognition transactions include that<br>I.gains on

Q137: During 2017,Stephanie earns $2,700 from a summer