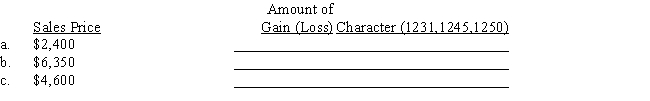

Maria acquired a personal computer to use 100% in her business for $6,000.She took MACRS deductions of $2,880 before selling it in current year.Determine the amount and character of the gain (loss)recognized on the sale of the computer,assuming a sales price that differs in each of the three independent situations:

Definitions:

Consolidated Long-term Liabilities

The total amount of long-term debts that a company reports on its balance sheet, including all of its subsidiaries.

Voting Shares

Voting shares are shares of stock in a company that grant the shareholder the right to vote on corporate matters, typically in proportion to the number of shares held.

Fair Value

The approximate financial worth of an asset or liability, determined by existing prices in a transparent and contestable market.

Q3: Which of the following is/are correct concerning

Q6: Ling owns 3 passive investments.During the last

Q16: When a corporation pays a dividend,it is

Q26: Zeppo and Harpo are equal owners of

Q56: Pomeroy Corporation has a company health-care plan

Q77: Ralph buys a new truck (5-year MACRS

Q83: Land in London,England for land in San

Q88: Jim places a new lift truck (7-year

Q134: Gains on the sale of certain types

Q144: Moving expenses incurred on a job related