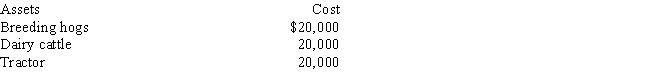

Determine the MACRS cost recovery deductions for 2017 and 2018 on the following assets that were purchased for use in a farming business on July 15,2017.The taxpayer does not wish to use the Section 179 election.

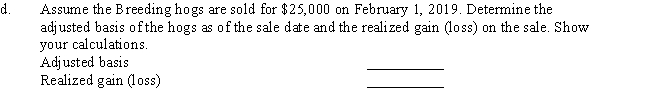

a.Breeding hogs depreciation:

Total 2017 Breeding hogs Cost Recovery Deduction (show your calculations)

Total 2018 Breeding hogs Cost Recovery Deduction (show your calculations)

b.Dairy cattle depreciation:

Total 2017 Dairy Cattle Cost Recovery Deduction (show your calculations)

Total 2018 Dairy Cattle Cost Recovery Deduction (show your calculations)

c.Tractor depreciation:

Total 2017 Tractor Cost Recovery Deduction (show your calculations)

Total 2018 Tractor Cost Recovery Deduction (show your calculations)

Definitions:

Q3: Sarah owns a passive activity that has

Q20: Which of the following will render a

Q23: Determine the adjusted basis of the following

Q31: Personal property consists of any property that

Q65: Split basis<br>A)Begins on the day after acquisition

Q72: Legal expenses are generally deductible if they

Q74: Carrie owns a business building with an

Q78: Lindsey exchanges investment real estate parcels with

Q96: Hugh donates investment real estate to Habitat

Q100: Will and Brenda of New York City