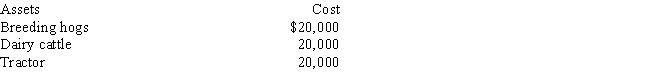

Determine the MACRS cost recovery deductions for 2017 and 2018 on the following assets that were purchased for use in a farming business on July 15,2017.The taxpayer does not wish to use the Section 179 election.

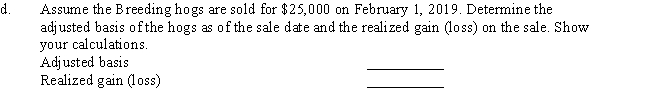

a.Breeding hogs depreciation:

Total 2017 Breeding hogs Cost Recovery Deduction (show your calculations)

Total 2018 Breeding hogs Cost Recovery Deduction (show your calculations)

b.Dairy cattle depreciation:

Total 2017 Dairy Cattle Cost Recovery Deduction (show your calculations)

Total 2018 Dairy Cattle Cost Recovery Deduction (show your calculations)

c.Tractor depreciation:

Total 2017 Tractor Cost Recovery Deduction (show your calculations)

Total 2018 Tractor Cost Recovery Deduction (show your calculations)

Definitions:

Ability to Function

The capacity of an individual to perform tasks or roles in the course of daily life, often in the context of health and disability.

Family Relationships

The interpersonal connections and interactions within a group of individuals related by blood, marriage, law, or quasi-familial ties.

Chronic Disorders

Long-lasting, persistent health conditions that can be controlled but not necessarily cured.

Acute Disorders

Conditions that come on quickly and can be severe but are of a short duration.

Q33: If an employer reimbursement plan is an

Q49: Valerie receives a painting as a gift

Q65: Split basis<br>A)Begins on the day after acquisition

Q66: The wash sale provisions apply to which

Q73: William has the following capital gains and

Q78: On March 23,2017,Saturn Investments Corporation purchases a

Q94: If more than 40% of the depreciable

Q100: Randy owns 115 acres of land with

Q101: During 2017,Linda has a $12,000 net loss

Q163: Certain interest expense can be carried forward