Essay

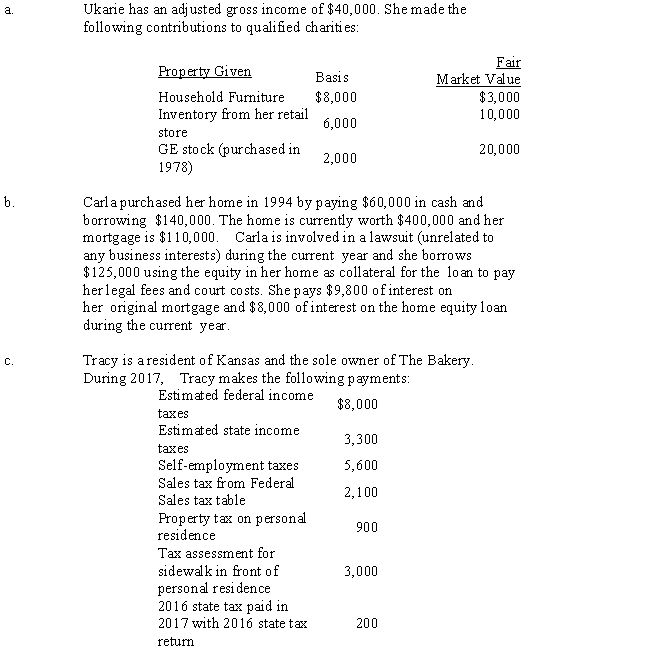

For each of the following situations,determine the amount of the allowable deduction.Be sure to show any necessary calculations and provide explanations of how you determined the deductible amount.

Definitions:

Related Questions

Q52: Pedro sells a building for $170,000 in

Q58: Linc,age 25,is single and makes an annual

Q74: Determine the proper classification(s)of the asset discussed

Q79: Hamlet,a calendar year taxpayer,owns 1,000 shares of

Q81: Alternate valuation date<br>A)Begins on the day after

Q86: Which of the following intangible assets is

Q91: Melissa sells stock she purchased in 2004

Q118: Jenny,an individual cash basis taxpayer,has $6,000 of

Q121: Health Savings Accounts are available only to

Q133: Brees Co.requires its employees to adequately account