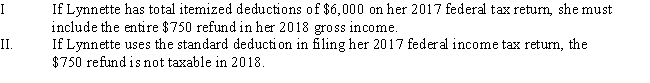

Lynnette is a single individual who receives a salary of $36,000.During 2017,she has $6,800 withheld for payment of her federal income taxes and $2,900 for her 2017 state income taxes.In 2018,she receives a $450 refund after filing her 2017 federal tax return and a $750 refund after filing her 2017 state tax return.

Definitions:

Prepared Script

A pre-written text intended for use in speeches, presentations, or media productions to ensure consistency and accuracy.

Informative Headings

Titles or captions that clearly and succinctly describe the content or purpose of the sections they precede, enhancing readability and navigation.

Social Media

Websites and platforms that allow users to generate and distribute their own content as well as engage in social networking activities.

Traditional Media

Forms of mass communication that existed before the advent of digital media, such as newspapers, television, and radio.

Q1: Dana purchases an automobile for personal use

Q42: Lisa sells some stock she purchased several

Q45: A taxpayer can deduct multiple gifts to

Q59: Morrison received a gift of income-producing property

Q73: In addition to his salary,Peter realizes a

Q77: Lu is interested in purchasing the assets

Q96: Mark and Cindy are married with salaries

Q110: Which of the following taxes paid by

Q115: Which of the following is not deductible?<br>A)Expenses

Q126: Sidney owns a residential rental property with