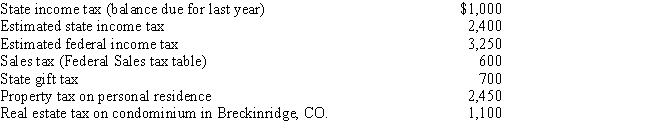

During the current year,Robbie and Anne pay the following taxes:

What amount can Robbie and Anne claim as an itemized deduction for taxes on their federal income tax return for the year?

Definitions:

Increased Demand

A situation where the desire or need for a product or service grows, often leading to higher sales or consumption.

Pure Competition

A market structure characterized by a large number of small firms, a homogeneous product, and easy entry and exit from the market.

Long Run

A period in which all factors of production and costs are variable, enabling full adjustment to change.

Short Run

A period in which at least one input in the production process is fixed, and only some inputs can be adjusted by firms.

Q36: Sally purchased new equipment for her consulting

Q54: Dwight owns an apartment complex that has

Q55: Sullivan,a pilot for Northern Airlines,has adjusted gross

Q69: Ernest went to Boston to negotiate several

Q75: Eduardo is a single taxpayer with a

Q82: On June 10,2016,Wilhelm receives a gift of

Q102: Amortization<br>A)Computers,and automobiles.<br>B)Used to recover the investment in

Q103: Collectible gain (loss)<br>A)Stocks,bonds,options.<br>B)Depreciable real property.<br>C)All or part

Q123: Susan is the owner of a 35-unit

Q125: Michelle is a bank president and a