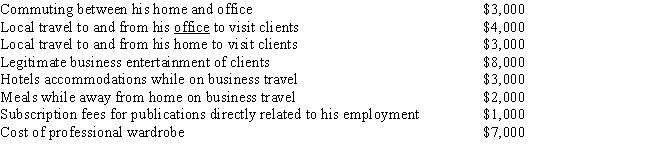

Julius is an employee of a large consulting firm.During the year he incurs the following expenses in his job,none of which are reimbursed by his employer.Julius's adjusted gross income is $100,000 before considering these expenses.

What is Julius's miscellaneous itemized deduction?

Definitions:

Collaborative Relationships

A partnership or working relationship where two or more parties work together towards a common goal, often seen in business contexts for mutual benefit.

Adversarial Arrangements

Situations or agreements where parties involved have opposing interests or are in competition with each other.

Creative Problem Solvers

Individuals or groups who use innovative and imaginative approaches to finding solutions for complex issues or challenges.

Q1: Paul owns a lumber yard in Portland.He

Q12: Arlene,a criminal defense attorney inherits $500,000 from

Q36: Discuss the general differences between Section 1245

Q44: Walter pays a financial adviser $2,100 to

Q48: Marshall and Michelle are married with salaries

Q92: The earlier the depreciation deduction can be

Q100: While most rental activities are classified as

Q108: Brenda sells stock she purchased in 2004

Q120: Daisy's warehouse is destroyed by a tornado.The

Q129: Mary Lou is a 22-year old student