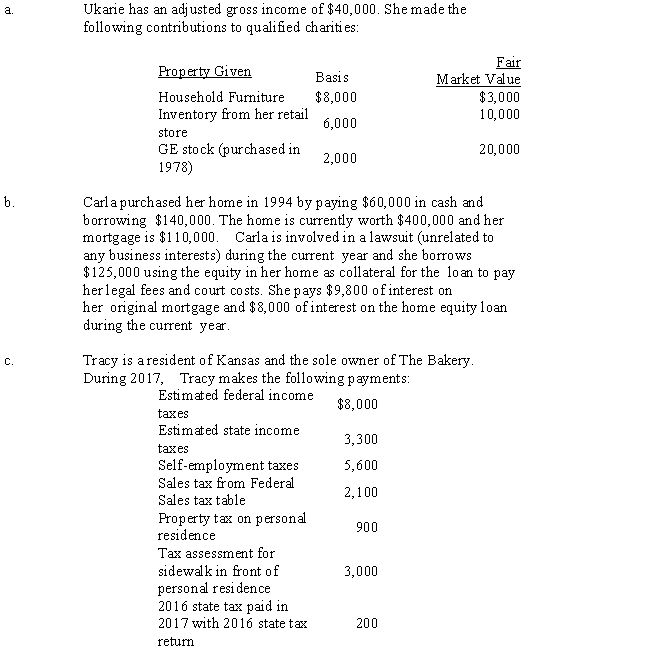

For each of the following situations,determine the amount of the allowable deduction.Be sure to show any necessary calculations and provide explanations of how you determined the deductible amount.

Definitions:

Nominal Interest Rate

The stated interest rate on a loan or investment, not adjusted for inflation.

Inflation Rate

The rate expressed in percentage terms by which the overall price level of goods and services increases, leading to a decrease in purchasing power.

Real Rate of Interest

The interest rate adjusted for inflation, reflecting the true cost of borrowing and the real yield to lenders.

Investment-Demand

The desire or willingness to allocate resources towards investment goods that are expected to yield returns in the future.

Q45: Points<br>A)Prepaid interest.<br>B)An amount that each taxpayer who

Q46: Associated with<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to $25

Q47: When her property was fully depreciated and

Q52: Standard deduction<br>A)Prepaid interest.<br>B)An amount that each taxpayer

Q56: In May,Josefina receives stock worth $10,000 from

Q81: Indicate which of the following statements is/are

Q82: Smokey purchases undeveloped land in 1999 for

Q100: A capital asset includes which of the

Q119: Michael,age 42 and single,has a 13-year-old son,Tony.Tony

Q122: Which of the following expenditures are not