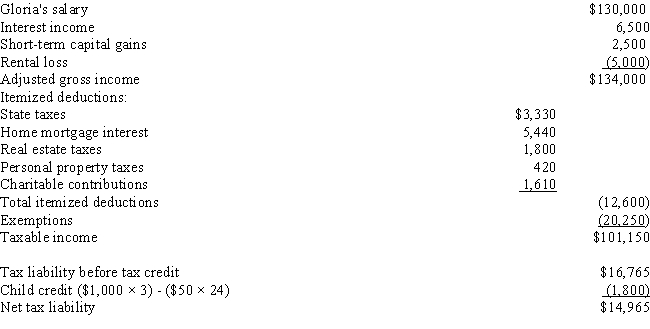

COMPREHENSIVE TAX CALCULATION PROBLEM.Girardo and Gloria are married with 3 children,ages 14,11,and 8.Gloria is a senior vice-president for a security firm and Girardo is a househusband who spends 15 hours a week doing volunteer work for local organizations.Girardo inherited $800,000 from his grandfather in 1999.He spends 10 hours a week managing the rental property they purchased with part of the inheritance and the family's stock portfolio.Prior to becoming a househusband,Girardo was an award winning high school accounting teacher.In February of 2016,Girardo is approached by the high school principal about returning to his former position.Girardo would receive an annual salary of $50,000.He is a little hesitant about accepting the offer,because he enjoys his volunteer work.Girardo's accountant has provided him with the following projection of their 2017 tax liability:

Girardo's projection from his accountant does not include his salary from teaching.Assume that Girardo's pro-rata salary for the year will be $30,000.Calculate Girardo and Gloria's tax liability,if Girardo decides to return to teaching.Also determine the marginal and effective tax rates on Girardo's salary.

Definitions:

Social Venture Capitalists (SVCs)

are investors who provide capital to businesses making a positive social or environmental impact, prioritizing social returns alongside financial ones.

Impact-Investment Funds

Funds invested with the intention to generate positive, measurable social and environmental impact alongside a financial return.

Social Entrepreneurship

A practice of starting businesses with the aim of solving social problems or effecting social change.

Environmental Problems

Issues affecting the natural environment, including pollution, climate change, deforestation, and loss of biodiversity.

Q37: An individual should be indifferent whether an

Q45: Points<br>A)Prepaid interest.<br>B)An amount that each taxpayer who

Q79: In which of the following circumstances will

Q90: Sylvia owns 1,000 shares of Sidney Sails,Inc.

Q95: A limitation exists on the annual amount

Q97: Which of the following taxes paid by

Q100: Brent purchases a new warehouse building on

Q127: Which of the following must be classified

Q129: Mary Lou is a 22-year old student

Q143: Garcia is a self-employed chiropractor and a