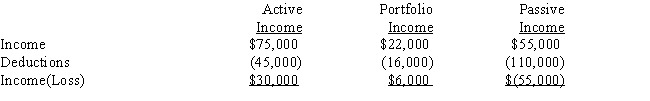

A taxpayer had the following for the current year:

I.If the taxpayer is a closely held corporation,taxable income from the three activities is income of $6,000.

II.If the taxpayer is an individual and the passive income is not related to a rental real estate activity,taxable income is $36,000.

Definitions:

Customer Confidence

The trust and belief that customers have in a company and its products or services.

Ethical Climate

The collective understanding within an organization of what is considered morally right or wrong, influencing ethical decision-making.

Performance Targets

Specific goals set by a company or an individual, often quantifiable, aimed at measuring success or achievement in certain areas.

Ethical Responsibility

This concept pertains to the duty to act in a morally sound way, considering the impact of one's actions on others and society.

Q13: Joline works as a sales manager for

Q28: Filing status<br>A)Unmarried without dependents.<br>B)Generally used when financial

Q41: Ying pays $170,000 for an office building

Q45: Hurst Company purchased a commercial building in

Q46: Chestnut Furniture Company purchases a delivery van

Q49: Discuss why listed property gets special attention.

Q55: Which of the following would not be

Q70: Which of the following legal expenses paid

Q84: Eloise is a sales representative for a

Q85: Davis owns and operates a convenience store