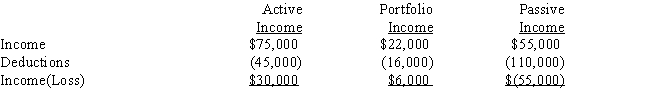

If a taxpayer has the following for the current year:

I.If the taxpayer is a regular corporation,taxable income from the three activities is a loss of $19,000.

II.If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant,taxable income is $11,000.

Definitions:

Civil Rights Movement

A social and political campaign in the United States during the 1950s and 1960s aimed at ending racial segregation and discrimination against African Americans.

New Deal

Franklin D. Roosevelt’s campaign promise, in his speech to the Democratic National Convention of 1932, to combat the Great Depression with a “new deal for the American people”; the phrase became a catchword for his ambitious plan of economic programs.

Libertarianism

A political philosophy that advocates for minimal government intervention in the personal and economic affairs of citizens, emphasizing individual liberty and free markets.

Jewish Presidential Candidate

A candidate for the presidency who identifies as Jewish, notable in the context of discussing diversity in political representation.

Q3: Bernice is the beneficiary of a $50,000

Q6: Which of the following is a currently

Q50: Tillman is building a warehouse for use

Q59: Troy Company purchased a printing press on

Q71: What is the MACRS recovery period for

Q88: George's wife sells stock she purchased 10

Q97: Dana purchases an automobile for personal use

Q100: Margaret is single and is a self-employed

Q126: Barney's sailboat is destroyed in an unusual

Q132: Production-of-income expense<br>A)Automobile used 75% for business.<br>B)Investment expenses